Choosing the Right Forex Trading Brokers for Your Investment Success

If you are venturing into the world of Forex trading, one of the most crucial steps you will take is selecting the right broker. This decision can significantly influence your trading experience and ultimately your profitability. With hundreds of trading brokers forex https://tradingplatform-hk.com/ available, knowing how to navigate this landscape is essential to your success.

Understanding Forex Brokers

Forex brokers serve as intermediaries between you and the foreign exchange market. They provide a platform for you to trade currencies, access market liquidity, and use various trading tools. Brokers can also offer educational resources, market analysis, and customer support. It’s important to understand the different types of brokers and their offerings.

Types of Forex Brokers

There are mainly two types of Forex brokers: Market Maker and ECN (Electronic Communication Network) brokers.

- Market Maker Brokers: These brokers create their own market for trading, setting their own bid and ask prices. They often make money through spreads and may offer fixed spreads. They might serve better for beginners because they can provide a stable trading environment.

- ECN Brokers: ECN brokers connect traders directly with other market participants, allowing for deeper liquidity and typically lower spreads. They charge a commission on trades, which can be a cost-effective choice for serious forex traders.

Key Factors to Consider When Choosing a Forex Broker

Choosing a Forex broker involves considering several important factors. Here are the key elements to look for:

1. Regulation

Ensure that the broker is regulated by a recognized financial authority. Regulations help protect your funds and ensure that the broker operates on ethical grounds. Major regulators include the U.S. Commodity Futures Trading Commission (CFTC), the Financial Conduct Authority (FCA) in the UK, and the Australian Securities and Investments Commission (ASIC).

2. Trading Costs

Understand the fees involved in trading with a broker. This includes spreads, commissions, and overnight financing fees (swap rates). Compare costs among different brokers to ensure you are getting a competitive deal. Lower fees can significantly impact your profitability over time.

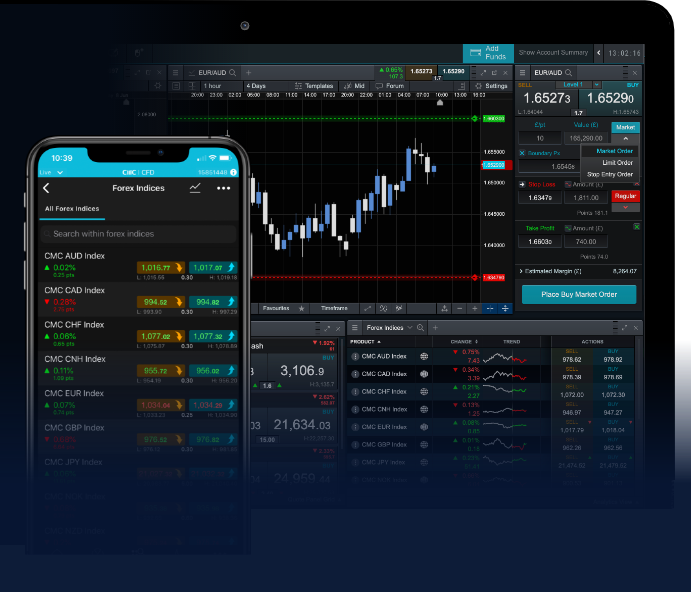

3. Trading Platform

A reliable and user-friendly trading platform is crucial for executing trades efficiently. Most brokers provide trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), or proprietary platforms. Test the platform through a demo account to ensure it meets your needs.

4. Customer Support

Quality customer support can be a lifesaver, especially if you encounter issues or have questions. Look for brokers that offer 24/7 support through multiple channels (live chat, email, or phone).

5. Leverage and Margin Requirements

Leverage allows you to control a larger position with a smaller amount of capital, potentially increasing your profits – but also your losses. Look into the leverage provided by the broker and understand the margin requirements for trading.

6. Range of Currency Pairs

The variety of currency pairs offered can greatly enhance your trading strategies. Ensure your broker provides access to major, minor, and exotic pairs, depending on your trading preferences and strategies.

Evaluating Broker Reputation

Before opening an account with any broker, it’s important to evaluate their reputation in the Forex trading community. This can involve:

- Reading online reviews and testimonials from other traders.

- Checking for any regulatory issues or disputes with clients.

- Exploring forums and social media for feedback about the broker’s services and reliability.

The Importance of Demo Accounts

Many brokers offer demo accounts, allowing you to trade with virtual money before committing real funds. This is an excellent way to familiarize yourself with the trading platform, test out strategies, and get a feel for the market without financial risk. Use the demo account as a learning tool to navigate the broker’s platform and services.

Making Your Final Decision

After thorough research and analysis of the brokers available, weigh the pros and cons of each to make an informed decision. Make sure the broker aligns with your trading goals, risk tolerance, and approaches. The right broker will provide the necessary tools, support, and environment to enhance your trading endeavors.

Conclusion

Choosing the right Forex trading broker can make a significant difference in your trading journey. By understanding the types of brokers, evaluating key features, and taking advantage of demo accounts, you can find a broker that suits your needs. Take your time in making this decision, as it is a critical step in achieving your trading objectives and financial success.

Remember, the world of Forex trading can be both lucrative and risky. Proper research and diligent selection of your trading broker will provide you with a solid foundation for your trading career.